tax effective strategies for high income earners

As a business owner one of the most important aspects of financial planning includes. Ad Stay Connected to the Most Critical Events of the Day with Bloomberg.

2022 Federal Budget Details Continued Spending With Limited Tax Measures Video Tax Authorities Canada

Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services. Among tax strategies for high-income earners this is one that you should pay very close attention to.

Contact a Fidelity Advisor. Health Savings Account Investing. Its possible that you could.

One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. Trusts and Income Splitting. Ad Holistic approaches to wealth management including tax planning and goal setting.

If theres potential for a high return by. 5 Tax Saving Strategies for High Income Earners Maximize Your Deductions. In 2021 the employee pre-tax contribution limit.

Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden. Ad Proven Asset Management Resources. Of short duration investment-grade money market and other fixed-income securities.

If you are over the age of. 1 day agoApplying tax-saving strategies for high-income earners could help you to owe less to the IRS each year. Software Trusted by Worlds Most Respected Companies.

When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. Build an Effective Tax and Finance Function with a Range of Transformative Services. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available.

Mercer Advisors is a full service wealth management firm with over 30 years of experience. Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. Ad Honest Fast Help - A BBB Rated. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

If you wish to save tax. Provided that you structure it properly a partnership or a. Its important to keep in mind however that the tax code is always changing.

The Internal Revenue Service IRS will never hold legal tax minimization strategies against any taxpayer regardless of what they earn. Contact a Fidelity Advisor. 100 Money Back Guarantee.

Ad Seek capital preservation and a higher rate of current income from a diversified portfolio. Change the Character of Your Income Convert your SIMPLE SEP or traditional IRA to a Roth IRA. So if the richest people in America can do it.

Among the best tax strategies for high income earners is to benefit from the fact that any contributions made to tax-free savings accounts grow tax-free and there is no tax. Tax Saving Strategies for High-Income Earners. Ad Access tax-forward insights tools strategies for maximizing after-tax return potential.

Max Out Your Retirement Account. At Eaton Vance we think about taxes year round so you can focus on what matters most.

Pin On Best Of The Millennial Budget

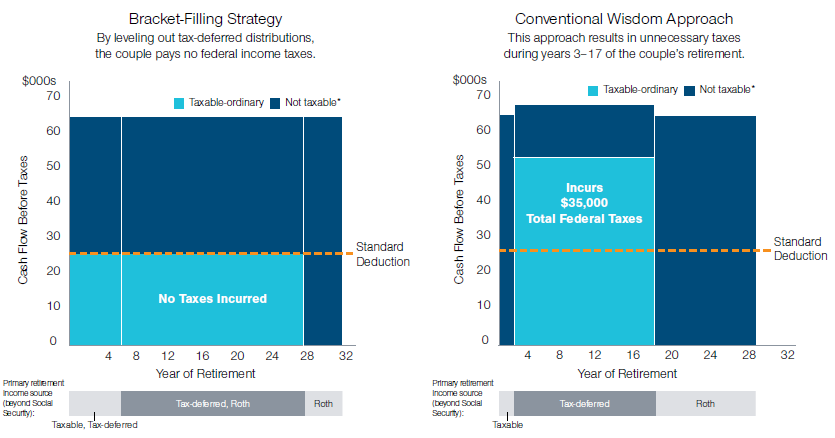

A Tax Savvy Approach To Help Make The Most Of Your Retirement Income T Rowe Price

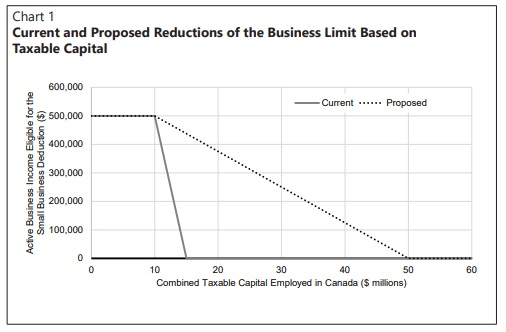

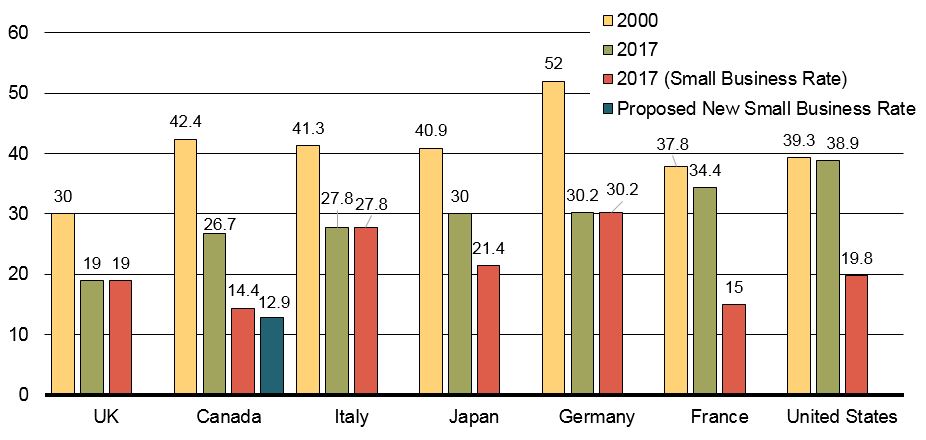

Backgrounder Reducing The Small Business Tax Rate Canada Ca

Tax Brackets For Ontario Individuals 2017 And Subsequent Years Md Tax

Personal Income Tax Brackets Ontario 2021 Md Tax

The 4 Tax Strategies For High Income Earners You Should Bookmark

The Pipeline Plan Shajani Llp Chartered Professional Accountants Advisors

How To Set Up A Backdoor Roth Ira For High Income Earners Money Management Money Management Advice Money Saving Strategies

How To Make 2020 Your Best Money Year Yet According To 9 Self Made Millionaires

The 4 D S Of Tax Planning To Help You Save Big Money Compass Wealth Partners

Tax Efficient Retirement Withdrawal Strategies

8 Ways To Help Lower Clients Taxes And Boost Their Retirement Savings Advisor S Edge

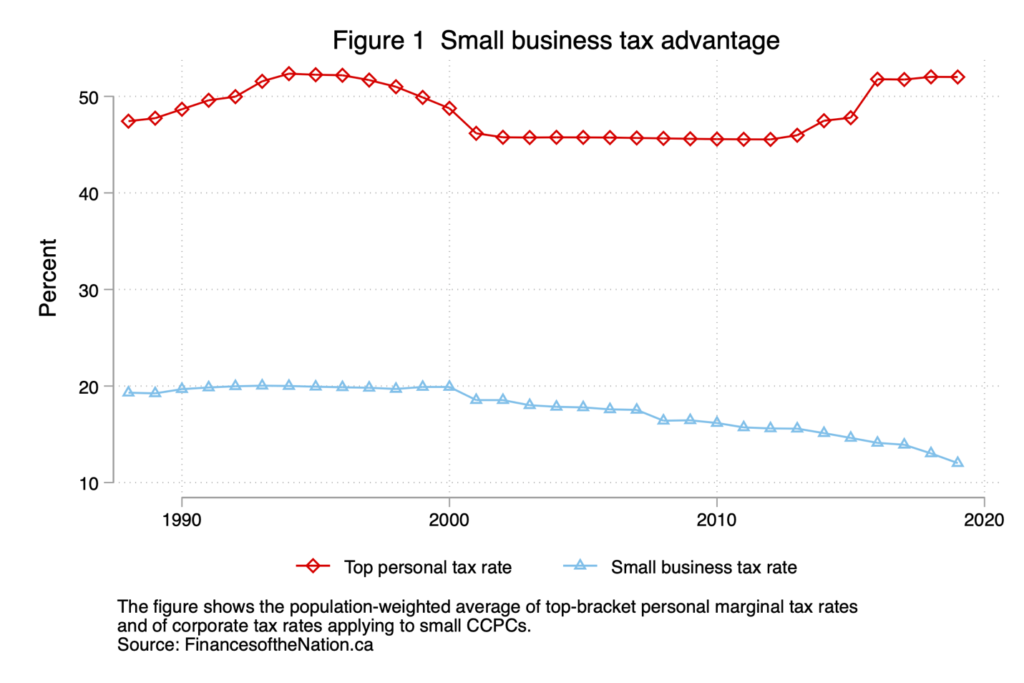

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

How To Pay No Tax On 100 000 Per Year In Canada Youtube

How Fortune 500 Companies Avoid Paying Income Tax

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmia Small Business Tax Accounting Business Tax

What Do Your Property Taxes Pay For Property Tax Consumer Math Family And Consumer Science

Worried About Taxes Going Up 9 Ways To Reduce Tax

High Income Earners Need Specialized Advice Investment Executive